Introduction

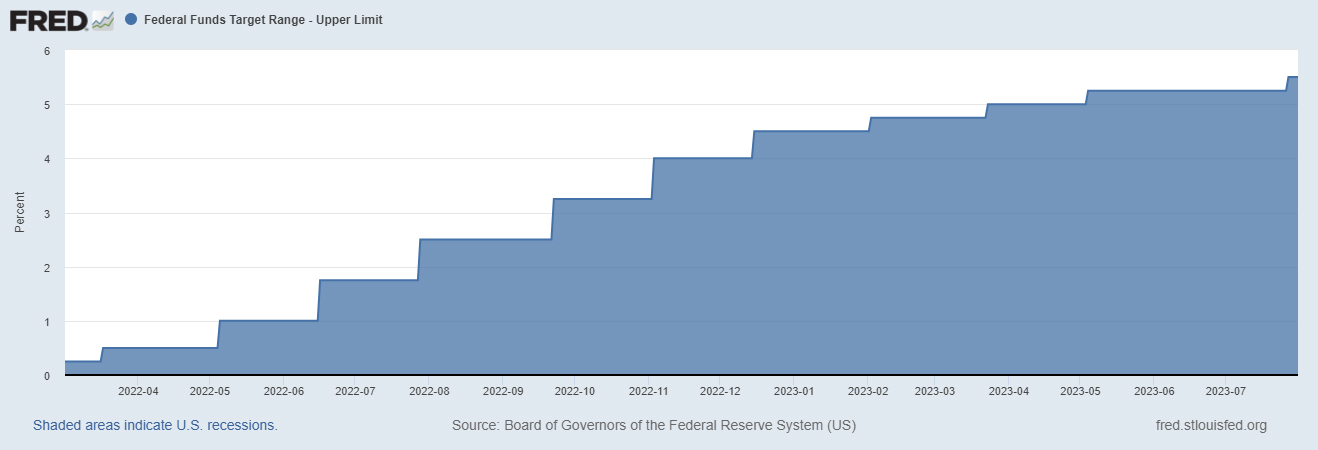

In the latter half of 2022 and the first half of 2023, the Federal Reserve embarked on an unprecedented rate hike cycle, raising interest rates from a historic low of 0.25% to 5.25%, in just 12 months. This aggressive monetary policy move, the fastest rate increases since the 1980s, has reverberated across financial markets and the broader economy. In comparison to the rate hike cycle of ’88-’89, which unfolded at a more gradual pace, the recent surge has caught many by surprise. As we delve into the details of this monetary policy shift, the consequences of the Federal Reserve’s actions on banking stability and inflation dynamics become apparent.

Historic Rate Hikes and the Banking Sector

The Effective Fed Funds Rate (“EFFR”), the benchmark interest rate controlled by the Federal Reserve, soared to 5.50%, marking the peak achieved in the ’04-’06 rate hike cycle. However, the most significant difference between the two cycles lies in the speed of rate adjustments. In the ’04-’06 period, it took the Fed two years to raise rates from 1% to 4.25%. In contrast, the current cycle witnessed a rapid escalation, with a whopping 5 percentage points increase achieved in just one year.

The rapid rate hikes had a profound impact on the banking sector, particularly during the first quarter of 2023. Several high-profile bank failures occurred as the rate-sensitive depositors sought higher returns and liquidity. With the Fed’s target rate reaching 5.50%, money market funds offered an attractive alternative for depositors looking to maximize their yields. Banks that failed to adapt to the changing environment faced liquidity challenges, leading to a significant outflow of deposits.

Silicon Valley Bank, a prominent tech-focused bank, experienced a deposit outflow of over $12 billion in the first quarter of 2023. Silvergate Bank, known for its digital currency-focused services, experienced deposits decrease of approximately $8 billion in the same period. Signature Bank and First Republic Bank also faced substantial challenges, with deposit outflows amounting to $5 billion and $3 billion, respectively. Large uninsured depositors diversified their holdings to well-capitalized money center banks covered under government protection, such as JPMorgan Chase, Bank of America, and Citibank. These uninsured depositors sought assurance that their cash holdings would be safeguarded even if the worst-case scenario of a bank failure occurred. The exodus of funds from these banks compounded the demand for liquidity and ultimately contributed to a destabilizing bank run.

Trends and Labor Market Resilience

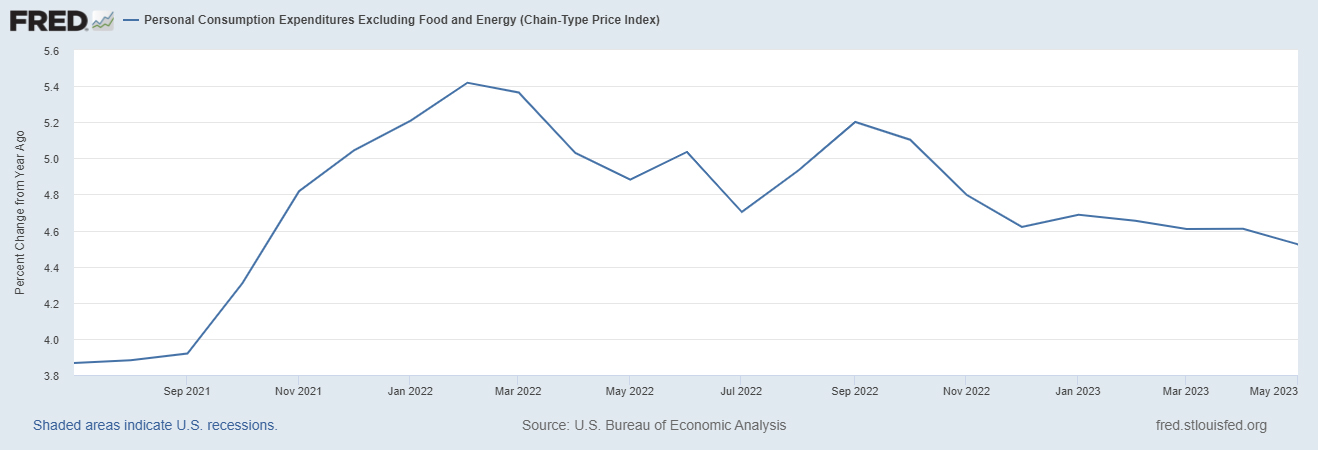

Now in the second half of 2023, the Federal Reserve is closely monitoring inflation trends to gauge the effectiveness of its rate hike measures. The Personal Consumption Expenditures price index, the central bank’s preferred inflation gauge, experienced a momentary deceleration in June, rising 3% for the 12 months ended in June. While this marked a slight ease from the previous month’s 3.8% increase, it still represented an elevated level of inflation.

Excluding volatile categories such as energy and food prices, the core PCE index rose 4.1% in June, marginally lower than economists’ expectations of a 4.2% increase. However, when compared to May’s annual increase of 4.6%, it is clear that inflation remains a significant concern for policymakers.

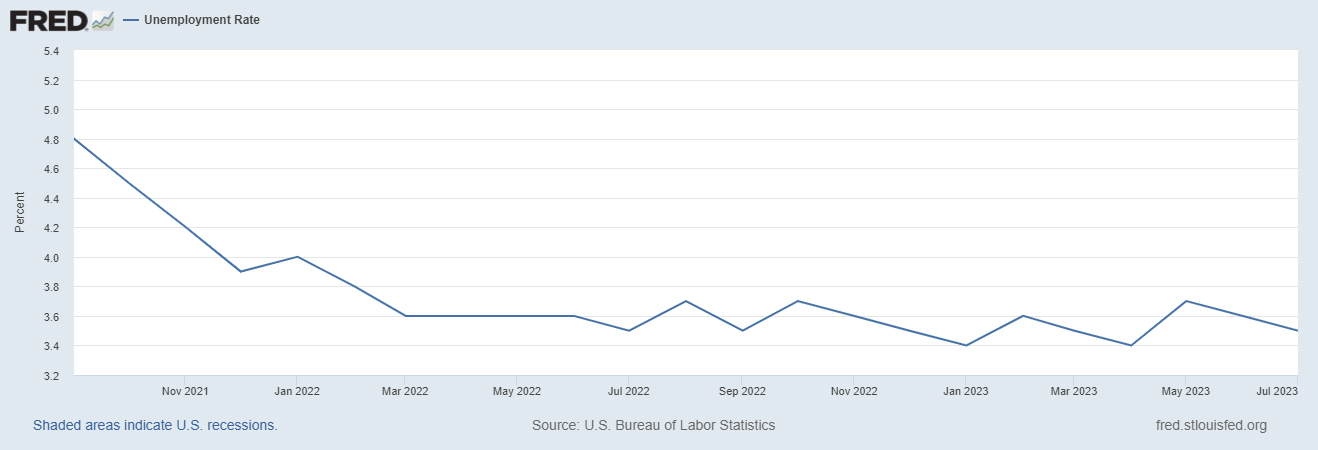

Despite inflationary pressures, the labor market has proven resilient during this period of uncertainty. Robust demand for workers has persisted, even as certain industries grapple with the impact of higher interest rates and inflationary costs. The labor market’s strength has presented a challenge for the Federal Reserve as it seeks to align future rate decisions with labor market activity.

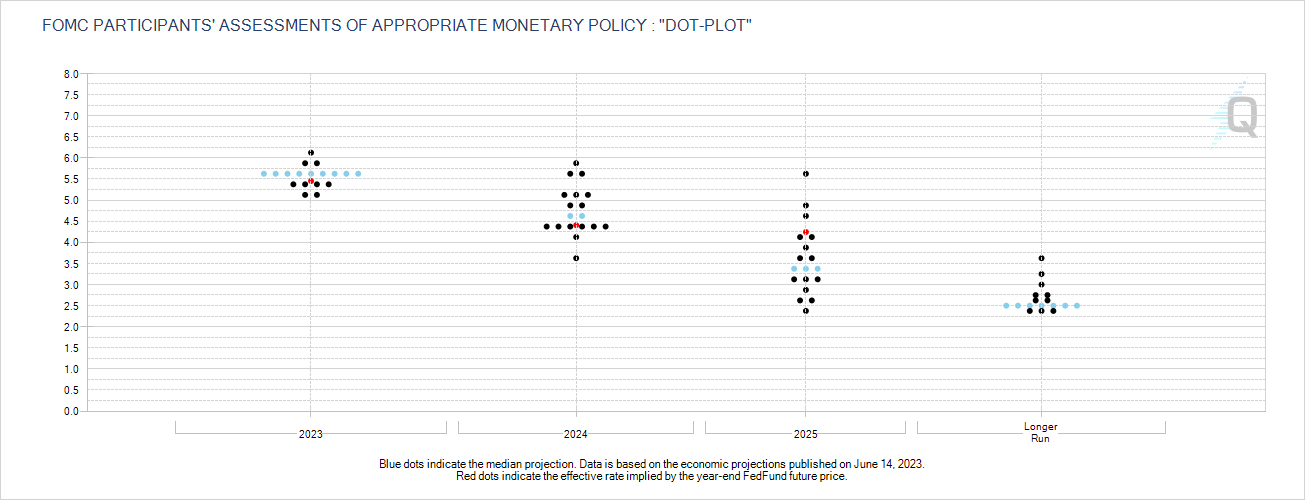

The Fed’s Dilemma and Future Rate Decisions

As the second half of 2023 unfolds, the Federal Reserve finds itself in a delicate balancing act. The persistent inflationary pressures, combined with a resilient labor market, pose a dilemma for the central bank. If inflation remains elevated and stubbornly above the Fed’s target of 2%, the inclination will be to continue signaling higher rates for a more extended period. The aim is to control inflation and maintain price stability.

However, the Federal Reserve must also consider the potential adverse effects of aggressive rate hikes on businesses and the overall economy. The recent tightening in financial services underwriting standards and the “shed the fat” mode seen in some companies, leading to workforce layoffs, highlight the risks associated with abrupt policy measures. U.S. banks are feeling the effects of the Federal Reserve’s interest-rate hike campaign, as evidenced by tighter credit standards and weaker loan demand during the second quarter of 2023. The Federal Reserve’s quarterly Senior Loan Officer Opinion Survey (SLOOS) data reveals that the central bank’s efforts to slow down the nation’s financial gears are taking effect as intended.

According to the SLOOS report, survey respondents indicated that lending standards have been tightened for both businesses and consumers, while loan demand has seen a decline across various categories. These trends are expected to persist as banks project further tightening of credit standards over the course of 2023.

Commercial Real Estate

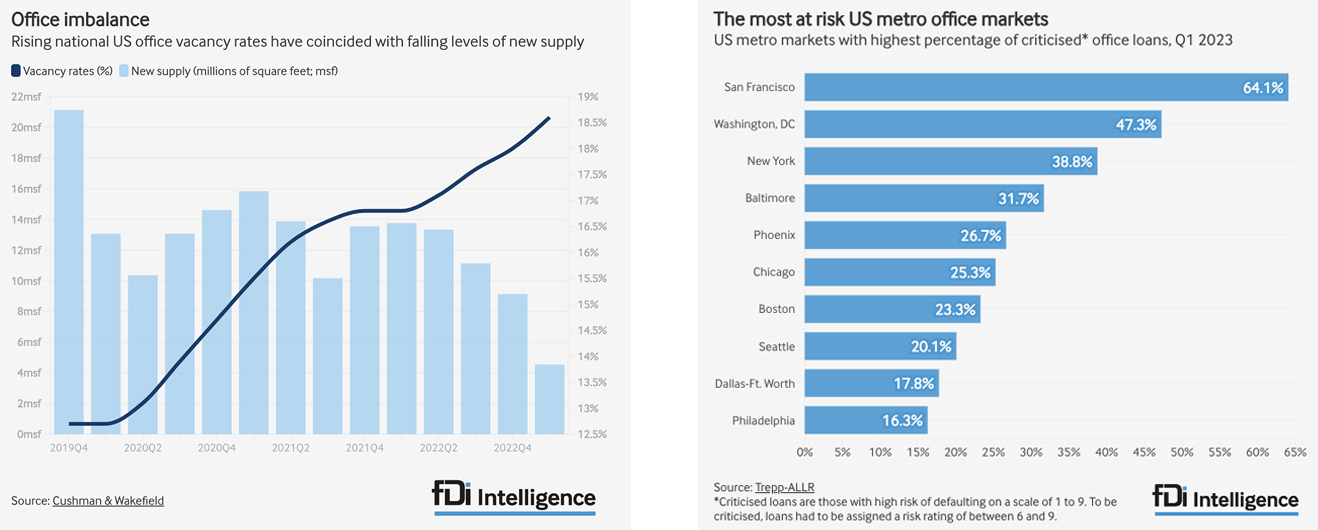

The Commercial Real Estate sector (CRE) is facing economic uncertainty as a result of the high interest rate environment and tight credit conditions. By 2025, an estimated $1.5 trillion in CRE loans will need to be refinanced at a higher interest rate. Economists predict that nonfarm, nonresidential properties face risk of default as lease demand continues to decline. Banks in the United States account for nearly 40% of CRE loans, or $1.7 trillion, many banks are looking to sell portions of their CRE loan portfolio to reduce concentration risk.

The most vulnerable asset class is office buildings in major metro cities as vacancies continue to drive rent prices and collateral value down. With the surge in hybrid and remote work, demand for office space fell drastically and is not expected to recover in the immediate future. In Manhattan, the office vacancy rate rose to 22.4% in Q2 of 2023 and about 16% of property value was lost since 2019 highs. Concerns arise with office space as offices make up about 80% of new delinquencies in CRE loans. A-class office space have the lowest delinquency rates and are expected to remain relatively stable.

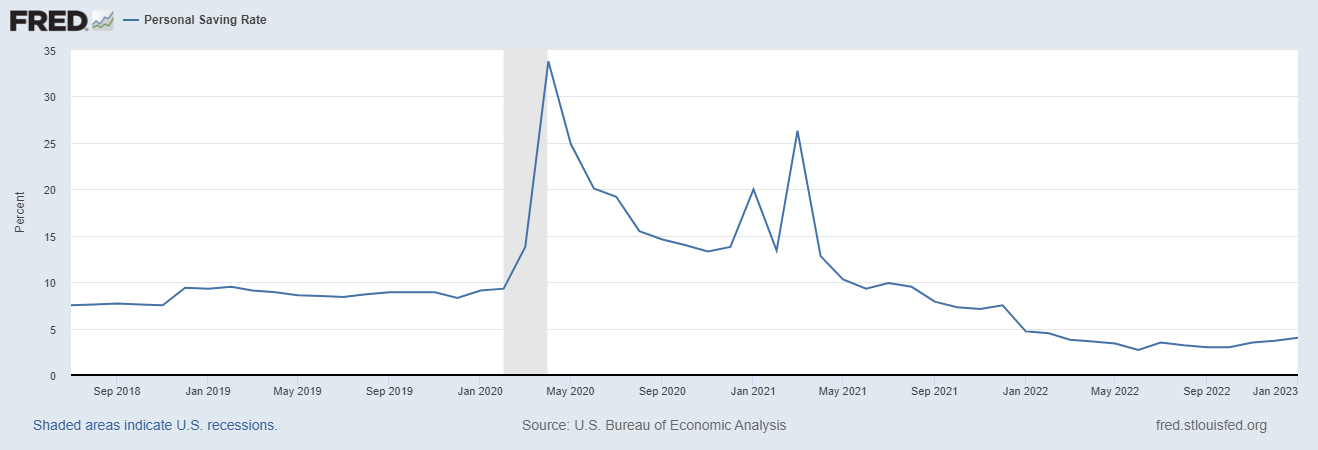

Consumer Savings and Credit

Since the start of 2022, the Personal Savings Rate (PSR) has remained under 5% after gradually declining from levels of over 10% in 2021. In June 2023 the PSR dropped down to 4.3%. Total personal savings also dropped in June 2023 to $862 billion. Economists attribute high inflation and higher interest rates as the reasons why consumers are saving less of their total disposable income.

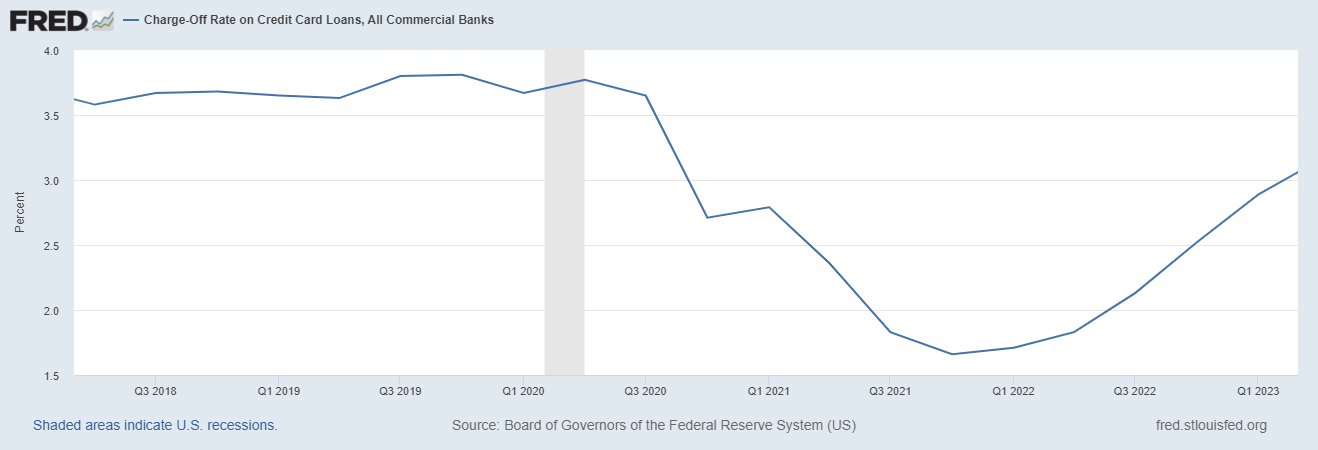

According to the Federal Reserve, total consumer credit reached levels of $5 trillion in June 2023. About $1 trillion of outstanding credit is from consumer credit cards. While consumer spending has exhibited resilience thus far, high interest rates will force consumers to either spend less or take on a higher burden of debt. Although the proportion of delinquent credit card loans to total credit card loans have remained low, banks are preparing an increase in defaults and charge-offs.

Conclusion

2022 and the first half of 2023 have witnessed an extraordinary rate hike cycle by the Federal Reserve, creating a seismic impact on the banking sector and inflation dynamics. High-profile bank failures and deposit and liquidity pressures underscore the need for cautious and strategic policy management in uncertain economic times. Now in the second half of 2023, the Federal Reserve faces a complex and challenging task in weighing inflationary pressures against labor market resilience when making future rate decisions. As we move forward, businesses and consumers may face higher borrowing costs and more stringent credit criteria, making it crucial for borrowers to carefully assess their financial decisions. While the central bank’s measures aim to ensure a stable economy, the tightening credit landscape may present challenges for businesses seeking expansion opportunities and consumers contemplating major purchases leading to an inevitable recession. Staying informed, adaptable, and vigilant will be key for businesses and investors as they navigate the potential consequences of these historic policy shifts.